Child traditional IRA

Transform your child's income into a retirement head start. Open a Traditional IRA for children with earned income and contribute up to $7,000 tax-deductible annually.

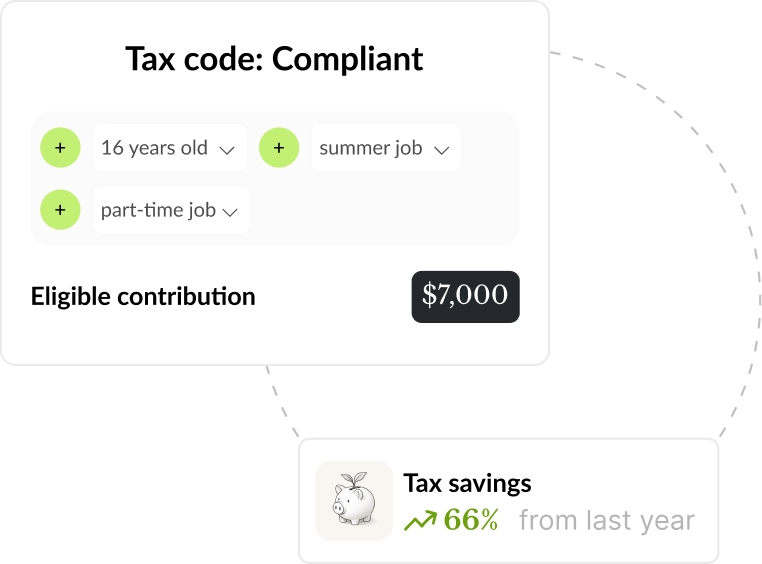

Calculate your child's IRA contribution opportunity

Determine how much your child can contribute based on their earned income from summer jobs, part-time work, or business activities. Maximum contribution is $7,000 or their total earned income.

Try for free

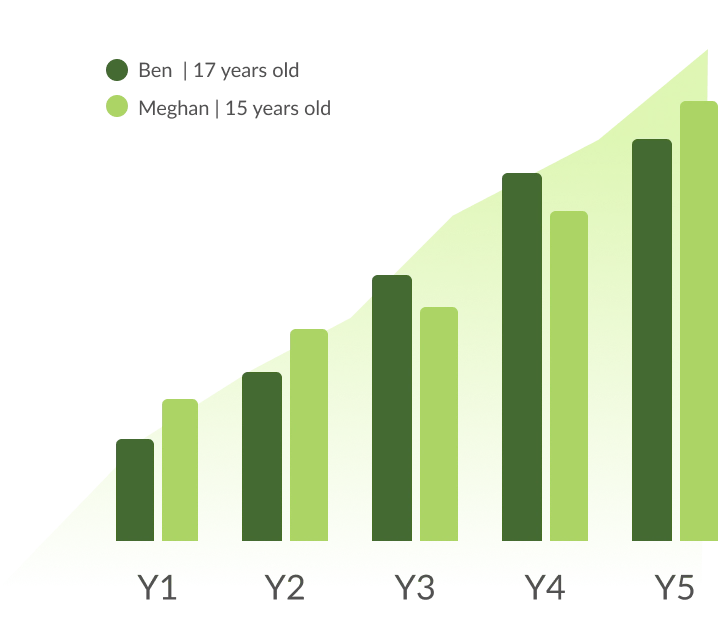

Maximize tax-deductible contributions for multiple children

Calculate contribution limits for each child individually, tracking earned income and available contribution space across all your children's Traditional IRAs.

Start for free

AI-powered contribution optimization ensures maximum benefits

Instead's AI analyzes each child's income patterns, suggests optimal contribution timing, and generates the documentation needed to substantiate earned income requirements.

Try for free

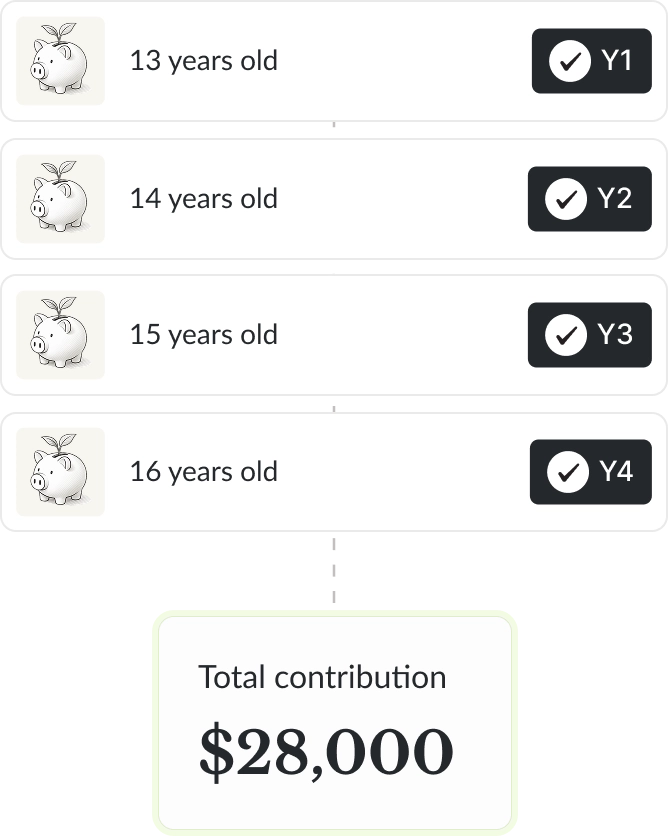

Build generational wealth through early retirement planning

Start your child's retirement savings decades early, allowing compound growth to work its magic. A $7,000 contribution at age 16 could grow to over $200,000 by retirement.

Get started today

File your return with confidence

With all contribution calculations documented and earned income verified, you're ready to claim the Traditional IRA deduction and secure your child's financial future.

Start today