What is the Alternative Minimum Tax (AMT)?

The Alternative Minimum Tax (AMT) is a tax imposed on high-income earners and households at a rate of 26% or 28%. Taxpayers calculate their regular tax and AMT and must take the greater tax. The AMT is typically triggered when there are certain types of income, such as bargain elements from discounted stock purchases, passive income losses or foreign tax credits. A much higher exemption amount is allowed under the AMT, but tax starts at the 26% bracket. The current exemption amounts are set to expire in 2026.

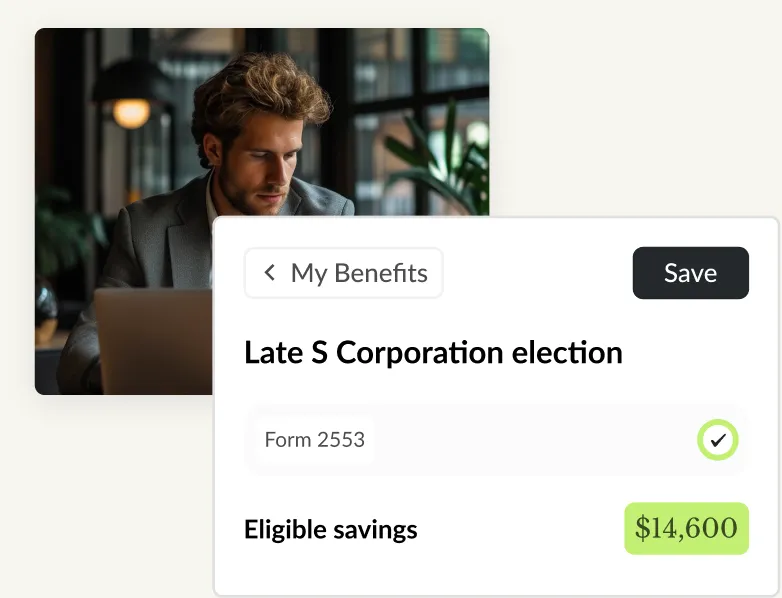

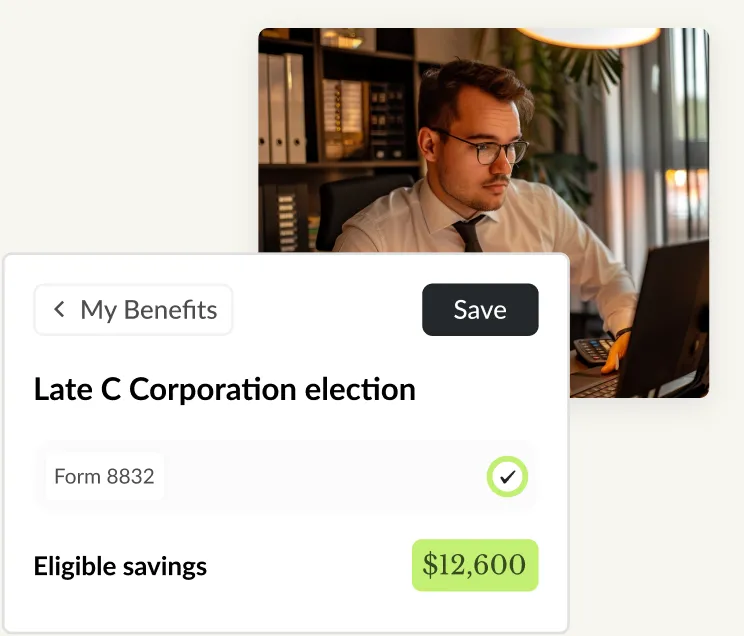

Easily save clients thousands in taxes.

Scan client returns.

Uncover savings.

Export a professional tax plan.