What is Tax Planning?

Tax planning is the process of analyzing a person’s or company’s financial situation and applying strategies to pay the lowest amount of taxes based on their facts and circumstances. Tax planning considers many factors, including cash flow, timing and reporting of income, tax credits, deductions, investments and expenditures. At its core, tax planning is about understanding how business and life decisions affect most people's largest expense — taxes.

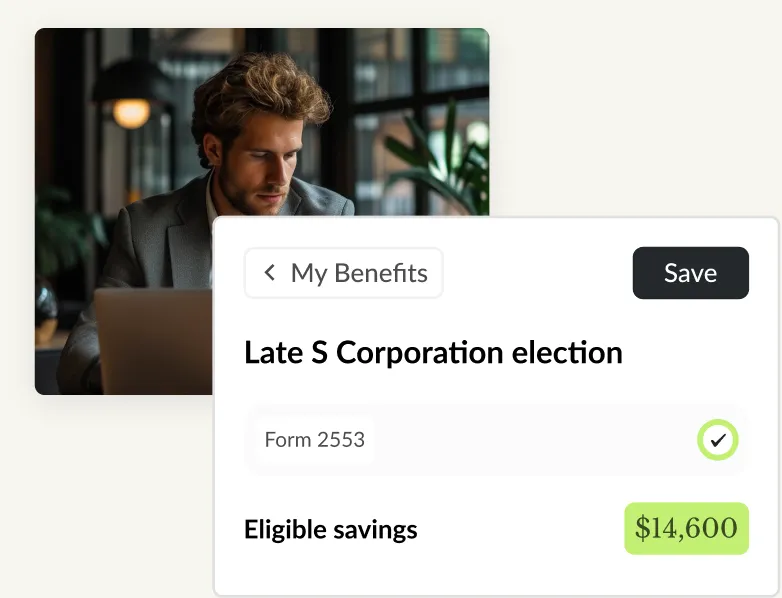

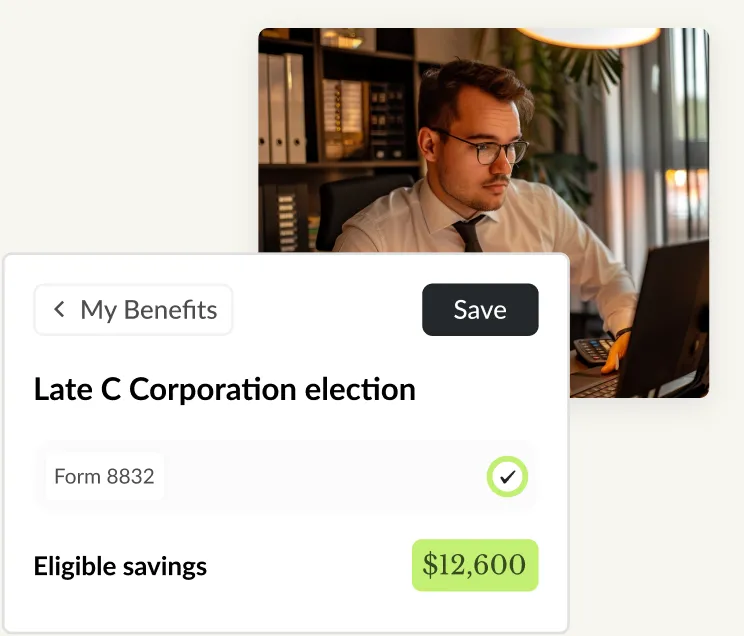

Easily save clients thousands in taxes.

Scan client returns.

Uncover savings.

Export a professional tax plan.