What is a Wash Sale?

In the context of tax loss harvesting, the “wash sale” rules state that your loss will not be allowed if, within 30 days before or after the sale of the security, you or your spouse invest in a security that is the same — referred to by the IRS as “substantially similar” — as the one you sold.

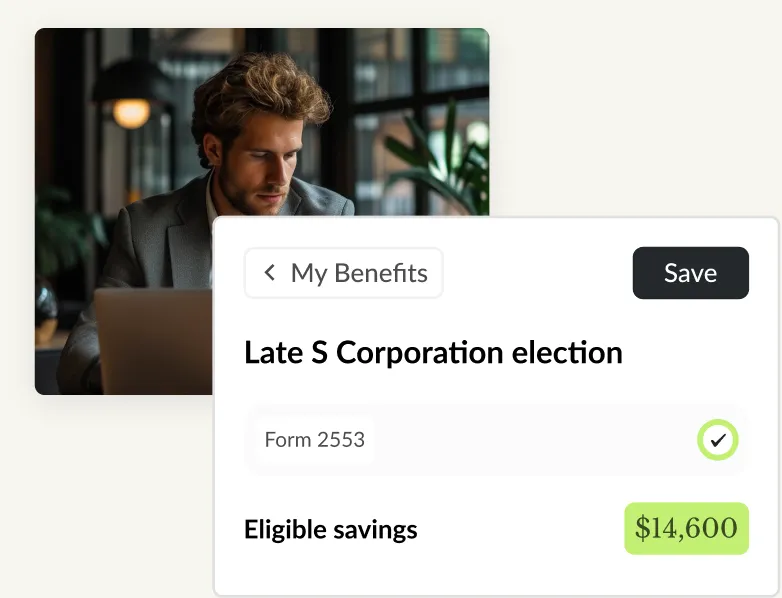

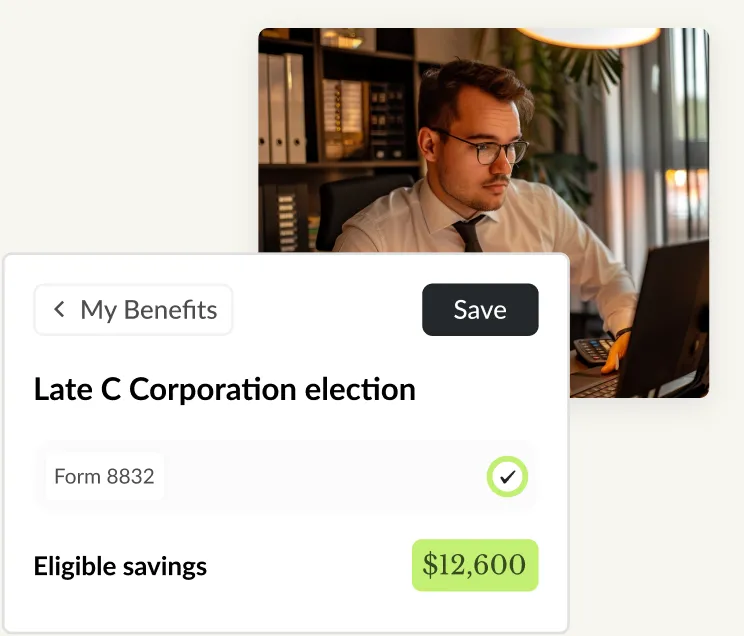

Easily save clients thousands in taxes.

Scan client returns.

Uncover savings.

Export a professional tax plan.