What is a Defined Benefit Plan?

A defined benefit plan is a type of qualified plan in which an employer or sponsor promises a specified pension payment to employees when they retire. The amount is predetermined using a formula based on the employee’s earnings history, tenure of service and age, rather than depending directly on individual investment return. Employers typically make most of the contributions to defined benefit retirement plans, although some plans allow for employee contributions and others may even require them.

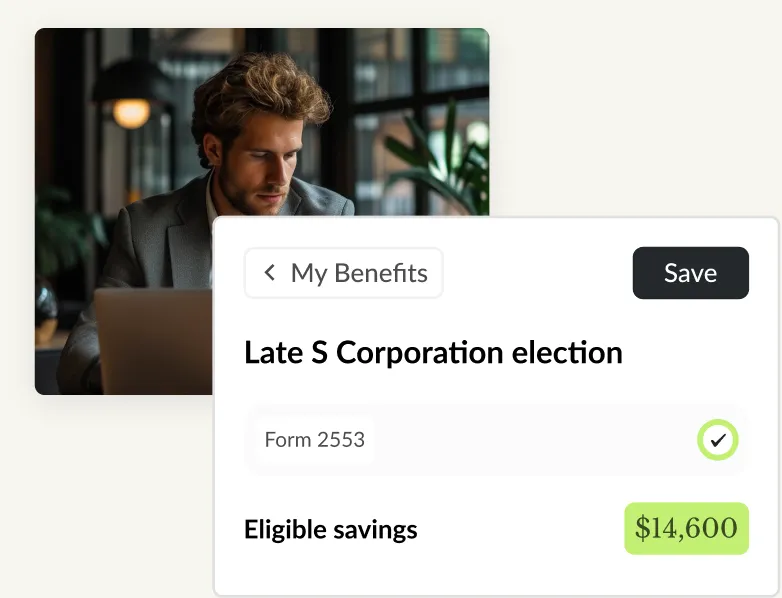

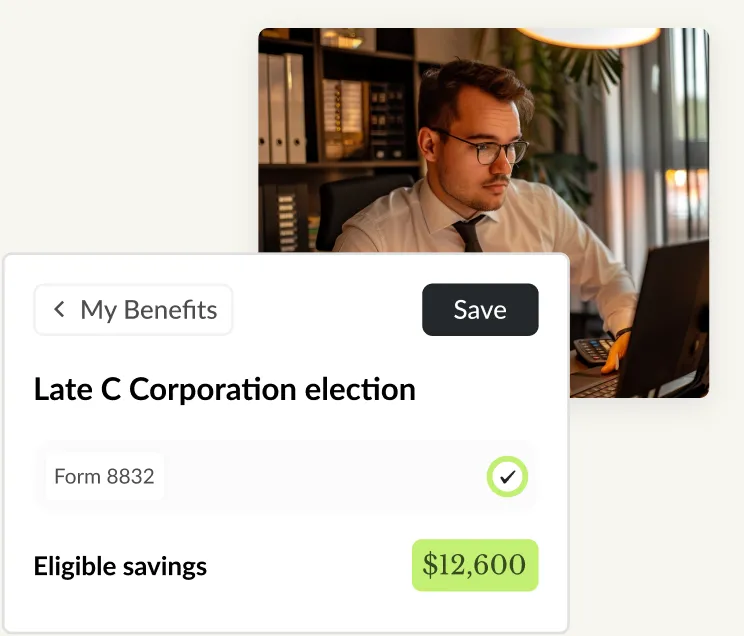

Easily save clients thousands in taxes.

Scan client returns.

Uncover savings.

Export a professional tax plan.