What are Itemized Deductions?

If a taxpayer opts not to take the standard deduction, they must itemize their tax deductions. This means the taxpayer must keep track of and list out all expenses paid during the year that are tax-deductible and file a Schedule A with their tax return. This is typically only done if the total of the taxpayer’s itemized deductions exceeds the standard deduction amount. Taxpayers who are married filing separately must itemize if their spouse itemizes their deductions.

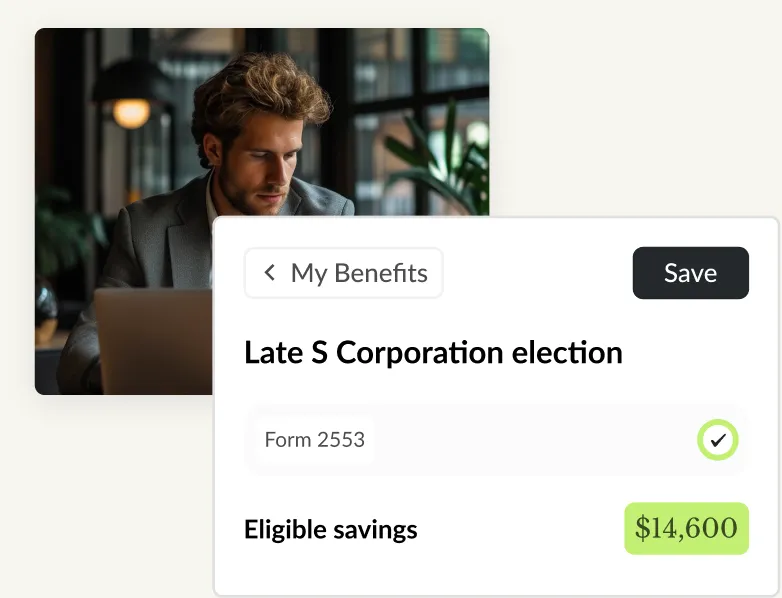

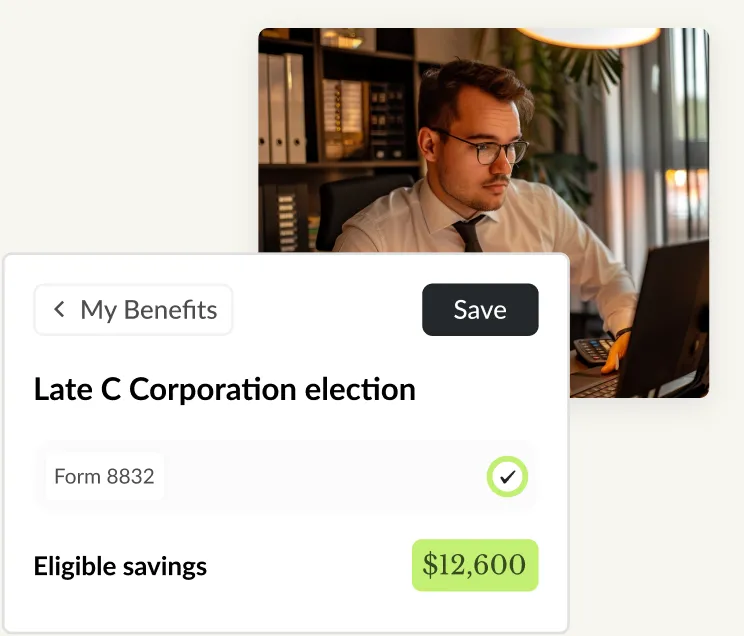

Easily save clients thousands in taxes.

Scan client returns.

Uncover savings.

Export a professional tax plan.